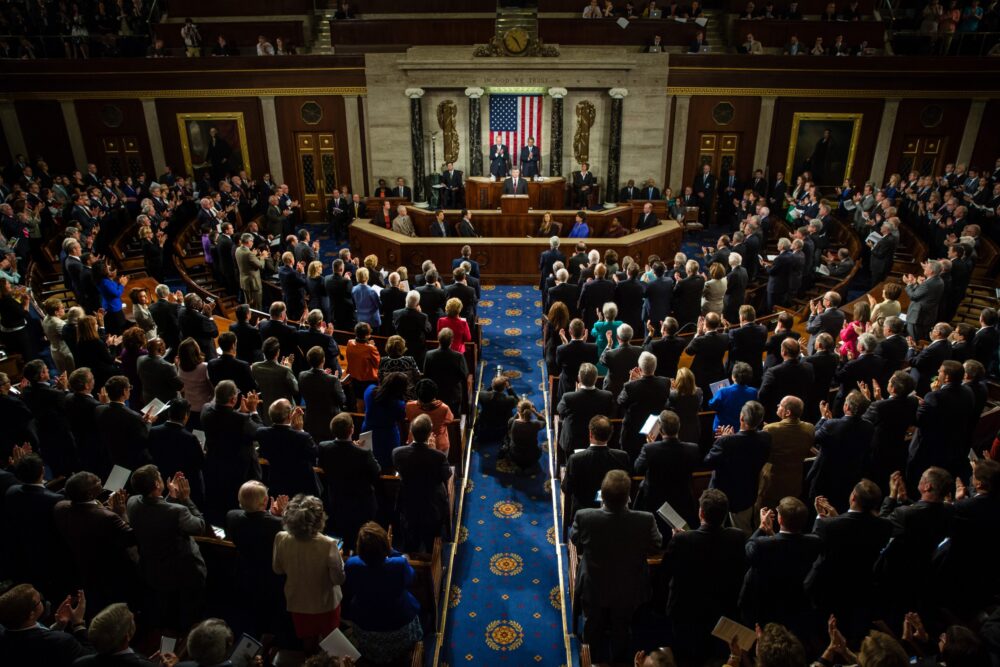

If you want to make a lot of money in the stock market, the people to take advice from aren’t the finance gurus on TV or the people on Wall Street. The people that you should follow are the elected officials sitting in Congress who are able to achieve “abnormal returns” on their investments. The good news is that these government officials have to disclose which stocks they choose to invest in, but the bad news is that this information is dated.

Still, even dated information can give you a glimpse at what type of companies that those in the US Congress choose to be part of their investment portfolio. The below information is from 2018 disclosures, the latest information currently available to the public according to OpenSecrets.org for the top 10 companies that members of the US Senate held.

While most of this article is derived from Opensecrets data, it is also supplemented by a more recent review of senatorial financial disclosures from senate.gov, as well as a review of media and research stories on the wealth of the Senate.

Here is the list of the top 10 stock investments held by the Senate.

#1 Apple Computer

#2 Microsoft Corp

Some senators

#3 Cisco Systems

Cisco Systems, Inc., usually known as Cisco, is an American digital communications and technology conglomerate. Cisco is one of the biggest technology companies in the world.

#4 General Electric

#5 Bank of America

Bank of America is owned equally by Democrats and Republicans, with the most recent data from Open Secrets saying that ten senators owned Bank of America shares. Of these ten, half were Republicans and half were Democrats.

#6 Amazon

According to Statistica.com, Amazon.com, Inc. is the world’s largest e-commerce retailer. It primarily sells consumer products and subscriptions through its website and physical stores. Amazon operates in three business segments, Amazon Web Services (AWS), International and North America. Amazon’s earnings in the past two quarters have been outstanding – beating analyst estimates by 30 cents in Q2 and 31 cents in Q3. They are on track to earn over 554.03 billion dollars per year.

#7 Alphabet

Alphabet, formerly known as Google (GOOG), is a multinational technology conglomerate. Alphabet has interests in internet search, artificial intelligence, cloud computing, computing and telephone hardware, software development, venture capital, telecommunications, and health care. In 2022, the company had $282.8 Billion in revenue.

Historically speaking, shares of Alphabet have been owned equally by Democrat and Republican senators. For example, in 2018, eight senators owned shares of Alphabet. Of these, three were Democrats and five were Republicans.

#8 Berkshire Hathaway

The Berkshire Hathaway company is an American conglomerate headquartered in Omaha, Nebraska. Berkshire’s main source of business is insurance. The company invests the funds from insurance premiums it receives in a broad portfolio of securities (here). Berkshire Hathaway has partial or complete ownership of several large and well-known brands including Duracell Distributing, International Dairy Queen, American Express, Kraft Heinz, Paramount Global, the Coca-Cola Company, Apple, and Bank of America.

Starting in 1965, Berkshire Hathaway has been overseen by CEO Warren Buffett and since 1978 vice chairman Charlie Munger.

The most recent data from Open Secrets shows nine senators with equity stakes in Berkshire. Ownership is bipartisan, with four of the nine senators owning Berkshire being Democrats, four Republicans and one being Independent.

#9 Exxon Mobil

Exxon Mobil is held by nine members of the Senate. This includes four Democrats, four Republicans, and one Independent.

#10 Johnson & Johnson

Of the 8 senators reporting they owned Johnson & Johnson, 3 were Republicans, 4 were Democrats and 1 was Independent.

Observations About Senate Ownership Of Stock

Here are some observations about the stocks owned by members of the Senate.

- They own very large amounts of stock. Of the 50 stocks most commonly held, only one senator reported owning less than $5,000 of a single company – this was the Comcast Corporation, owned by 5 senators. The minimum amount of a particular stock owned by the Senate, on average was $288,000.

- All the stocks in the top ten are large capitalization stocks – meaning their market capitalization (or market value * shares outstanding) is more than $10 billion. This means the companies senators are invested in are highly liquid. Large capitalization stocks also tend to be low-growth, reliable income payers.

- Most of the companies in the top ten are dividend payers. Of the companies in this list, all pay a regular quarterly dividend. The exceptions are Alphabet Inc., Amazon, and Berkshire Hathaway.

- What is also interesting is what members of the Senate are not holding. A brief review of the financials of the richest members of the Senate suggests that they by and large avoid highly speculative investments such as penny stocks or BBB-rated bonds. They also do not appear to be holding new or speculative fintech assets such as peer-to-peer lending or large amounts of cryptocurrency.

How Members of Congress Made Their Money

Members of Congress have levels of wealth consistently higher than the general public.

- Family Money/Inheritance: Senators often come from families of substantial means. For example, in 2007 Senator Mitch McConnel received a $25,000,000 inheritance. This elevated his net worth to over $27 Million dollars.

- Businesses: Many senators started successful businesses before their government work. For example, Senator Mitt Romney (R-Utah) founded a successful investing company – Bain Capital. And Senator John Hoeven (R-North Dakota) – owned a stake in a bank before joining the Senate.

- Investing: By and large, members of the US Senate hold large amounts of financial assets. For example, a review of Senator Rick Warren’s financial disclosures (here), shows dozens and dozens of large holdings in mutual funds, bond funds, and ETF funds held by the Senator and his family.

- Salary: Senators are paid a salary of $175,000 per year. The president pro tempore earns an annual salary of $193,400 and the majority and minority leaders earn $193,400 respectively (here).

- Leveraging their position/insider trading: Data shows that members of the Senate have a 2% advantage over the general public in their stock market returns. As members of government, senators have access to non-public information that substantially impacts the stock market. Observers often suggest these ‘abnormal returns’ are due to senators being able to trade on inside information. In addition, members of the Senate may also leverage their high net worth and social standing to get access to better quality financial advice than is available to the general public.

Invest Like Congress

Provided that you want to invest like members of Congress, here are some things you can consider doing

- Tracking bills that are working their way through the congressional approval process. You can check the progress of a bill here.

- You can take a position in a company that is consistently owned by members of the Senate. From the years 2014 to 2018, Apple Inc., Microsoft and Johnson & Johnson were consistently in senatorial portfolios.

2014 | 2015 | 2016 | 2017 | 2018 |

Apple Inc. | Apple Inc. | Apple Inc. | Johnson & Johnson | Apple Inc. |

General Electric | Procter & Gamble | Bank of America | Apple Inc. | Microsoft Corp |

IBM Corp | Johnson & Johnson | Cisco Systems | Cisco Systems | Cisco Systems |

Exxon Mobil | General Electric | General Electric | General Electric | General Electric |

Procter & Gamble | IBM Corp | Johnson & Johnson | Microsoft Corp. | Bank of America |

And the majority of them are reliable dividend payers.

In addition to studying the stocks owned by Congress, you might also read our other articles on wealth building:

Save a nest egg with the 52-week money challenge

Buy an oil well and improve your tax efficiency

Easily raise your credit score by 200 points

James Hendrickson is an internet entrepreneur, blogging junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

Comments