The cost of filing Chapter 7 or Chapter 13 bankruptcy is often daunting. Many people who are considering bankruptcy are already struggling to make ends meet. So, how on earth can you even afford to file bankruptcy? That is why one of the most important things to consider is how much does it cost to file bankruptcy.

The purpose of this article is to help you understand the following things:

- Explain the cost differences between Chapter 7 and Chapter 13 bankruptcy

- Help you understand payment plans that help with the bankruptcy cost

- Explain the pro se bankruptcy option (filing without a bankruptcy attorney)

Let’s get started.

The Cost to File Bankruptcy Between Chapter 7 and Chapter 13 Bankruptcy

Filing bankruptcy is often what people consider their last resort. It can negatively affect credit and also prevent access to future credit.

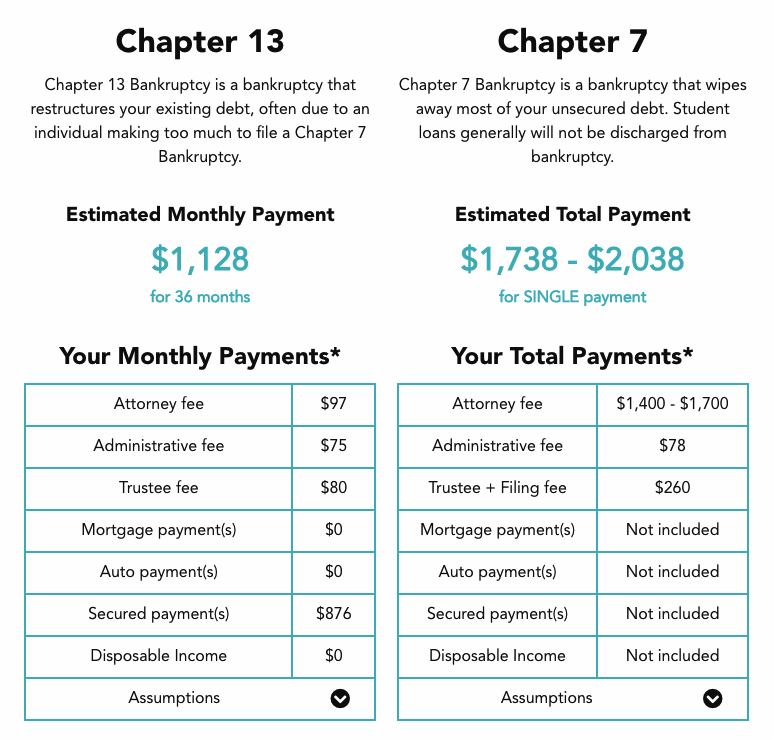

The two common types of bankruptcy are Chapter 7 and Chapter 13 bankruptcy.

The Chapter 7 bankruptcy is often less expensive. The bankruptcy attorney cost can range between $500 to $3000 across the United States. There is also a filing fee of around $300 to $350. That cost is often dependent on bankruptcy attorney interaction amount, simplicity of the Chapter 7 bankruptcy, and the attorney’s expertise and experience. In a Chapter 7 bankruptcy, you can often alleviate your debt in as little as 120 days.

The Chapter 13 bankruptcy often costs much more than the Chapter 7 bankruptcy. The cost can often range between $2,500 to $6,000, often based on a no look fee in a bankruptcy district. The filing fee can also cost between $300 to $350.

The Chapter 13 bankruptcy is often a much longer and complex process. It can take 3 or 5 years to get a bankruptcy discharge.

Because bankruptcy attorneys make higher fees from filing Chapter 13 bankruptcies, you may want to ask whether you would qualify for Chapter 7 bankruptcy in your free consultation. There are pros and cons to filing Chapter 7 bankruptcy or Chapter 13 bankruptcy, but it’s helpful to know those differences.

You may also want to take a free test calculator online to estimate whether you qualify for a Chapter 7 bankruptcy before you even enter the consultation.

Payment Plans Can Help Cover the Bankruptcy Costs

Thankfully, most bankruptcy attorneys take payments for both the Chapter 7 bankruptcy and Chapter 13 bankruptcy. You can ask about this in the free evaluation.

In a Chapter 7 bankruptcy, many attorneys will require that the full attorney fee be paid before filing. The reason for this is that your unsecured debt is often discharged in a bankruptcy. If you owe fees to the bankruptcy attorney, that may be discharged in the Chapter 7 bankruptcy.

With Chapter 13 bankruptcy, you would often have the bankruptcy attorney fees paid in the plan. In some cases, the bankruptcy attorney would require payment upfront, potentially due to the work that is required before filing. In other cases, the bankruptcy attorney may provide most of the fees in the Chapter 13 bankruptcy plan.

The cost to file bankruptcy can seem intimidating to many individuals. Often, bankruptcy attorneys offer payment plans that help alleviate the cost.

Lowest Bankruptcy Cost Option (But Do Your Research)

The United States government has a section specifically for those who are wishing to file without an attorney. This option is often referred to as pro se because you are simply representing yourself in the bankruptcy.

You would only be responsible for the filing fee and miscellaneous fees if you choose this route, but it’s important to do your research if you decide to file by yourself. The cost to file bankruptcy may be lower in this scenario, but there are numerous bankruptcy forms to fill out, and you do not want to get to a 341 meeting of creditors without doing your due diligence and putting your files together appropriately.

Conclusion

Hopefully, you now understand how bankruptcy works and how Chapter 7 bankruptcy and Chapter 13 bankruptcy filing differ. Also, take note that attorneys often take payment plans, so you can always work out a payment method that can work within your means.

Check out this guide on ‘When To Consider Bankruptcy’ to know if you need to take action as soon as possible, and then learn some more bankruptcy alternatives as well.

Comments